omaha nebraska vehicle sales tax

The latest sales tax rates for cities in Nebraska NE state. Search our Omaha Nebraska Sales And Use Tax database and connect with the best Sales And Use Tax Professionals and other Attorney Professionals in Omaha Nebraska.

Android Based And Nfc Enabled Mypos Smart Is A Credit Card Terminal Bringing Together Pos Payments And A New Generation Appmarket Packed With Business Apps

Sweet Life Quotes Images.

. This is the total of state county and city sales tax rates. Nebraska Non-motor Vehicle Sales Tax Collections by County and Selected Cities 19992021 Annual Non-motor Vehicle Sales Tax Collections Monthly Non-motor Vehicle Sales Tax Collections Non-motor vehicle sales tax collections are compiled from county and city information that is selfreported by applicants when requesting a sales tax permit. Omaha Ne Sales Tax Calculator.

The Omaha Sales Tax is collected by the merchant on all qualifying sales made within Omaha. Speak Victory Over Your Life Scripture. A vehicle that is recorded on the Purchasers Agreement which in turn is used to complete the Nebraska SalesUse Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales Form 6 as a trade-in must be titled in the name of the purchaser.

The Omaha Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Omaha local sales taxesThe local sales tax consists of a 150 city sales tax. The MSRP on a vehicle is set by the manufacturer and can never be changed. Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information Nebraska Sales Tax Rate Finder Nebraska Department of Revenue Skip to main content.

Nebraska has a 55 statewide sales tax rate but also has 295. 2020 rates included for use while preparing your income tax deduction. The December 2020 total.

You can find more tax rates and. Once the MSRP of the vehicle is established a Base Tax set in Nebraska motor vehicle statutes is assigned to the specific MSRP range and motor vehicle tax is then assessed. 4 rows The current total local sales tax rate in Omaha NE is 7000.

This example vehicle is a passenger truck registered in Omaha purchased for 33585. Nebraska collects a 55 state sales tax rate on the purchase of all vehicles. The Nebraska sales tax rate is currently.

You can find these fees further down on the page. 2019 Net Taxable Sales. This means that depending on your location within Nebraska the total tax you pay can be significantly higher than the 55 state sales tax.

2020 Sales Tax 55. Acknowledge receipt of payment from and do hereby sell and. Vehicles in Nebraska are registered in the county where the vehicle has situs which means in the county where the vehicle is housed majority of the time.

Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less. Nebraska City 20 75 075 16-339 33705 Nehawka 10 65 065 240-340 33740 Neligh 10 65 065 91-341 33775 Nelson 10 65 065 80-342 33880 Newman Grove 15 70 07 98-346 34230 Niobrara 10 65 065 73-349 34370 Norfolk 15 70 07 15-351 34615 North Bend 15 70 07 92-353 34720. The minimum combined 2022 sales tax rate for Omaha Nebraska is.

BILL OF SALE DATE OF SALE MODAYYEAR I in consideration of the payment of the sum of Transferor Seller PLEASE PRINT. 2019 Sales Tax 55. The percentage of the Base Tax applied is reduced as the vehicle ages.

Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective July 1 2022. There are no changes to local sales and use tax rates that are effective July 1 2022. Campos Tax Services Edinburg Tx.

In addition to taxes car purchases in Nebraska may be subject to other fees like registration title and plate fees. Newly purchased vehicles must be registered and sales tax paid within 30 days of the date of purchase. 301 Centennial Mall South PO Box 94789 Lincoln NE 68509- 4789 402 471-3918 State of Nebraska.

Department of Motor Vehicles. State Sales Tax 184718 Motor Vehicle Tax 700 Local Sales Tax 50378 Omaha Wheel Tax 50 Motor Vehicle Fee 30 Passenger. Download all Nebraska sales tax rates by zip code.

Nebraska has a 55 statewide sales tax rate but also has 334 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0825 on top of the state tax. The Omaha sales tax rate is. The County sales tax rate is.

Rates include state county and city taxes. The Nebraska state sales and use tax rate is 55 055.

Auto Service Inspection Parts Installation Specials In Omaha Ne

Superlative 1927 Sinclair Aviation Gasoline Restored American Visible Gas Pump Model 2487 Barrett Jackson Auction Vintage Gas Pumps Gas Pumps Petrol Station

Chevy Cars Trucks Suvs For Sale Omaha Ne

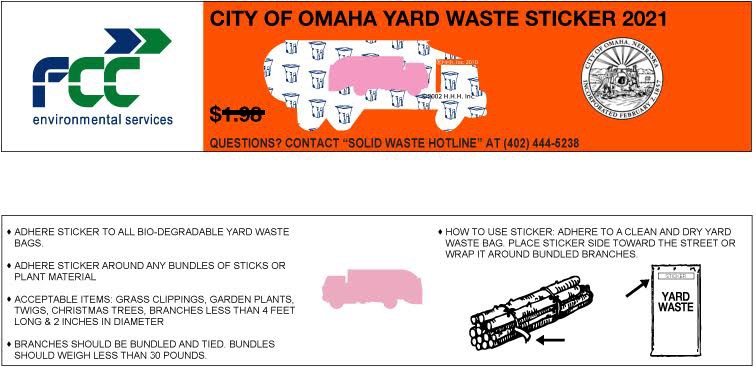

Yardwaste Sticker Locations And Instructions Wasteline Omaha

Free Nebraska Purchase Agreement Form Pdf 2883kb 17 Page S Page 2 Purchase Agreement Agreement Legal Forms

Map Of Peony Park Vintage Beach Posters Omaha Nebraska Vintage Beach

/cloudfront-us-east-1.images.arcpublishing.com/gray/ERD7U2NLDJAL5B5TXL3JGLQZ4Y.jpg)

Downtown Omaha Plan Adds Streetcar Puts Mutual Of Omaha Into Current Library Space

My Bike Hello Moto Suzuki Motorcycle

Motor Vehicles Douglas County Treasurer

Sales Tax On Cars And Vehicles In Nebraska

Motor Vehicles Douglas County Treasurer

Fenway Park Motors In The Late 1950 S Cool Old Cars Boston Pictures Old Pictures

Pros And Cons Of An Open House In Omaha Nebraska Sell My House Fast Sell My House Open House

/cloudfront-us-east-1.images.arcpublishing.com/gray/27LYAQ243FFAHMRDXWUVRORVBQ.jpg)

Downtown Omaha Plan Adds Streetcar Puts Mutual Of Omaha Into Current Library Space

R M Auto Sales Cars For Sale Auto The Body Shop

Cb 500 2001 Cb 500 Garagem Dos Sonhos

Jarts My Friends And I Used To Love Playing With These Then Kids Started To Get The Heavy Metal Points St Outdoor Games Adults Childhood Memories Childhood