mobile county al sales tax rate

The minimum combined 2022 sales tax rate for Mobile Alabama is. If you need access to a database of all Alabama local sales tax rates visit the sales tax data page.

Alabama Sales Tax Guide For Businesses

Payments are due on or.

. The County sales tax rate is. In 2018 the Alabama State Legislature passed Act 2018-577 giving tax collecting officials an alternative remedy for collecting delinquent property taxes by the sale of a tax lien instead of the sale of property. 3925 Michael Blvd Suite G Mobile AL 36609.

The Mobile County Alabama sales tax is 550 consisting of 400 Alabama state sales. Drawer 1169 Mobile AL 36633. Mobile County Commission Votes to Accept 22 Million Grant for Lower Halls Mill Creek Protection Project.

Morgan County AL Sales Tax Rate. Montgomery County AL Sales Tax Rate. 3925 Michael Blvd Suite G Mobile AL 36609.

The December 2020. Beginning with tax year 2019 delinquent properties the Mobile County Revenue Commission decided to migrate to the. A county-wide sales tax rate of 15 is.

Our window hours will be extended for the Mardi Gras season. The balance is distributed among agencies that provide public safety fire protection public health the construction and maintenance of roads bridges and other public services dedicated to preserve and improve our countys infrastructure. Revenue Office Government Plaza 2nd Floor Window Hours.

Pickens County AL Sales Tax Rate. 3 rows The current total local sales tax rate in Mobile County AL is 5500. SALES TAX ALCOH.

This is the total of state county and city sales tax rates. Revenue Commissioner Kim Hastie. The Alabama sales tax rate is currently.

Vending food products 3000. Marshall County AL Sales Tax Rate. Starting 211 - 2252022 hours will be Mon.

21 rows The Mobile County Sales Tax is 15. 800 to 430 pm. Mobile AL 36652-3065 Office.

Drawer 1169 Mobile AL 36633. Alabama has 765 cities counties and special districts that collect a local sales tax in addition to the Alabama state sales taxClick any locality for a full breakdown of local property taxes or visit our Alabama sales tax calculator to lookup local rates by zip code. Mobile County AL Sales Tax Rate.

Pike County AL Sales Tax Rate. Fast Easy Tax Solutions. A mail fee of 250 will apply for customers receiving new metal plates.

Vending all other 4000. Mobile County Commission lauds Senator Shelby for 1B funding package. 10 rows INSIDE MobilePrichard OUTSIDE MobilePrichard UNABATED EDUCATION LODGING.

Ad Find Out Sales Tax Rates For Free. Perry County AL Sales Tax Rate. Late fees are 1500 plus interest and cannot be waived.

800 to 300 Monday Tuesday Thursday and Fridays and 800 to 100 Wednesdays. The 10 sales tax rate in Mobile consists of 4 Alabama state sales tax 1 Mobile. Monroe County AL Sales Tax Rate.

Alabama Legislative Act 2010-268 now mandates that customers using a Visa or Mastercard will be charged a 23fee 150 minimum for each registration year renewed as well as 100 mail fee for decals. Hudson Becomes Mobile County Commission President March 14. Mobile County levies a county wide Sales Use and Lease Tax and also administers a Mobile County School Sales and Use Tax in county areas outside the corporate limits of Prichard and MobileA county wide Lodging Tax is also levied.

Oxford 5 sales tax on the retail sale of alcoholic beverages by businesses licensed under Section 28-3A-21a6 Section 28-3A-21a7 Section 28-3A-21a8 Section 28-3A-21a14 or Section 28-3A-21a15 Code of Alabama 1975. In Mobile County almost 47 of the property taxes collected are for public education. What is the sales tax rate in Mobile Alabama.

Mobile AL Sales Tax Rate The current total local sales tax rate in Mobile AL is 10000. Revenue Commissioner Kim Hastie. The Mobile Alabama sales tax is 1000 consisting of 400 Alabama state sales tax and 600 Mobile local sales taxesThe local sales tax consists of a 150 county sales tax and a 500 city sales tax.

Reports and payment of these taxes are made to the License Commission Office after establishing a tax account. The Mobile Sales Tax is collected by the merchant on. Mobile County Commission American Rescue Plan Act Update.

States With Highest And Lowest Sales Tax Rates

Sales Tax Guide For Online Courses

Vehicle Sales Tax Deduction H R Block

The Tricky 10 States With The Most Complex Sales Tax Filing Rules

States With Highest And Lowest Sales Tax Rates

Alabama Sales Tax Rates By City County 2022

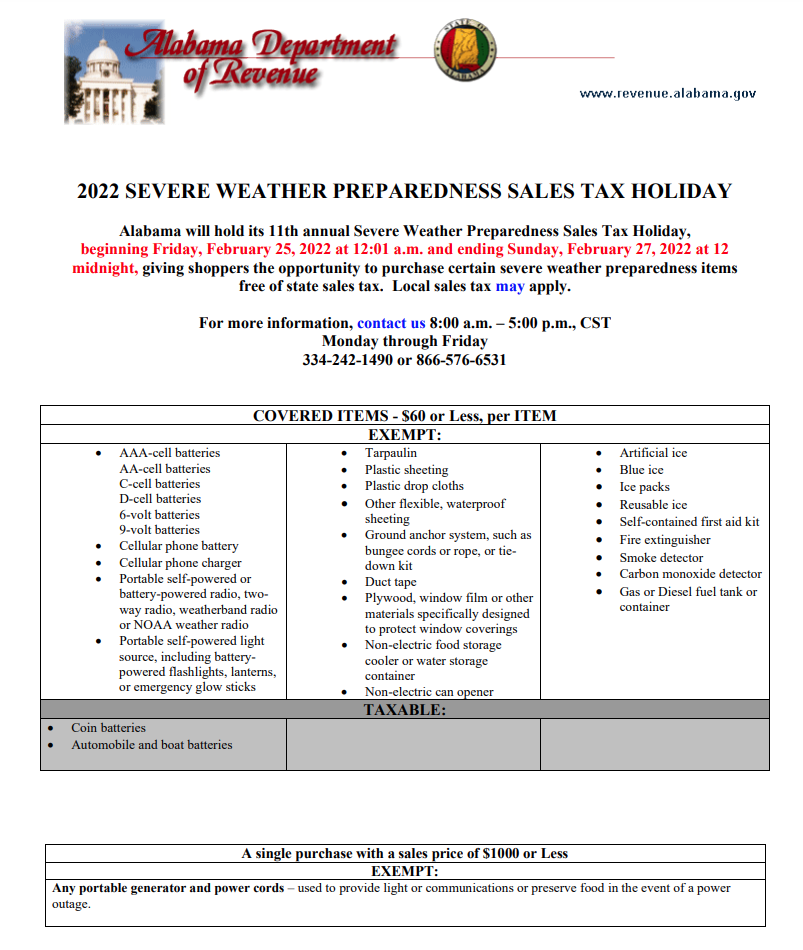

Alabama Severe Weather Sales Tax Holiday 2022 Starts Today What S On The List Al Com

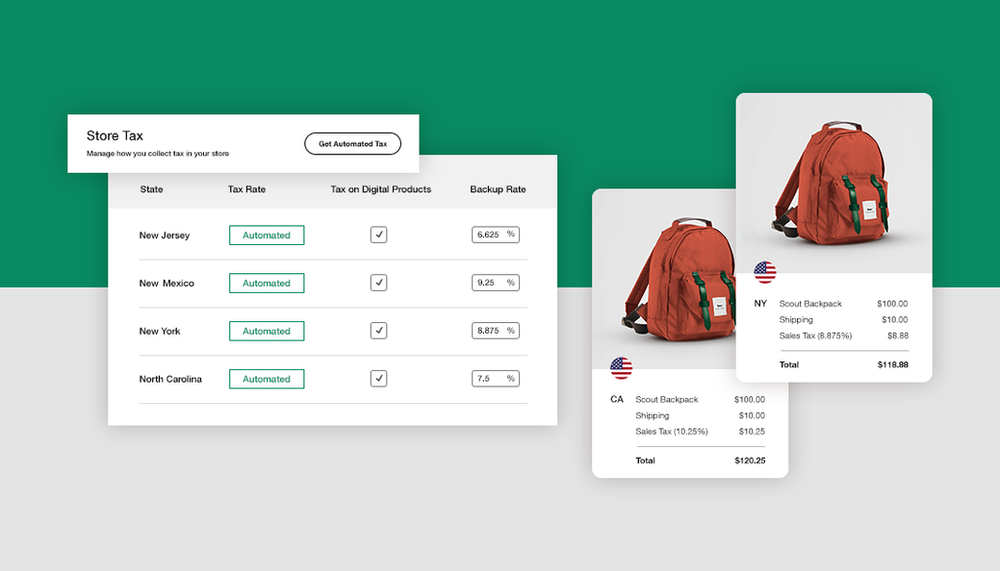

How To Charge Your Customers The Correct Sales Tax Rates

How Is Tax Liability Calculated Common Tax Questions Answered

Alabama Severe Weather Sales Tax Holiday 2022 Starts Today What S On The List Al Com

How To Charge Your Customers The Correct Sales Tax Rates

Sales Tax Guide For Online Courses

How To Charge Your Customers The Correct Sales Tax Rates

Alabama Sales Use Tax Guide Avalara

States Are Imposing A Netflix And Spotify Tax To Raise Money